Tax season is well and truly upon us. It's time to count the pennies and disclose exactly how much you earned, as well as how you earned it.

Calculating the correct amount of taxes is important. It can also be difficult. With that in mind, I've tracked down two Excel tax calculators to ensure you don't miss a single penny.

I have made every effort to ensure that these tax calculators work as they should, and they do, but your taxes are your responsibility. We're just helping you along the way.

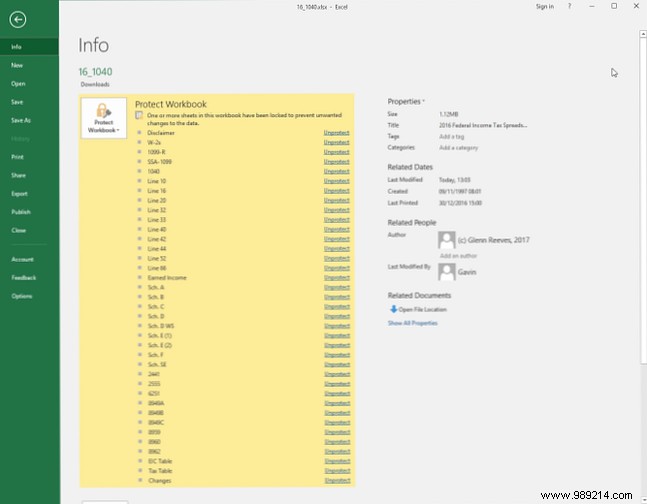

Let's start with one of the most complete calculators. Tax calculator creator Glenn Reeves has been updating and distributing his Excel template for over a decade, always for free. Reeves meticulously updates the template for each fiscal year, including all recent changes. Plus, Reeves keeps an up-to-date list of changes, so you know exactly where the template has changed.

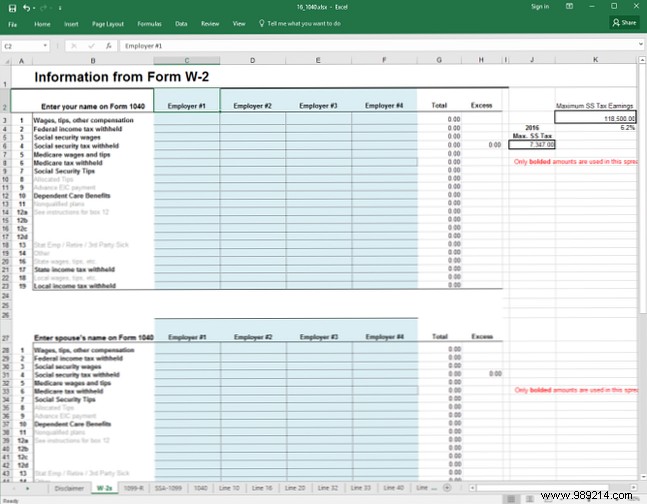

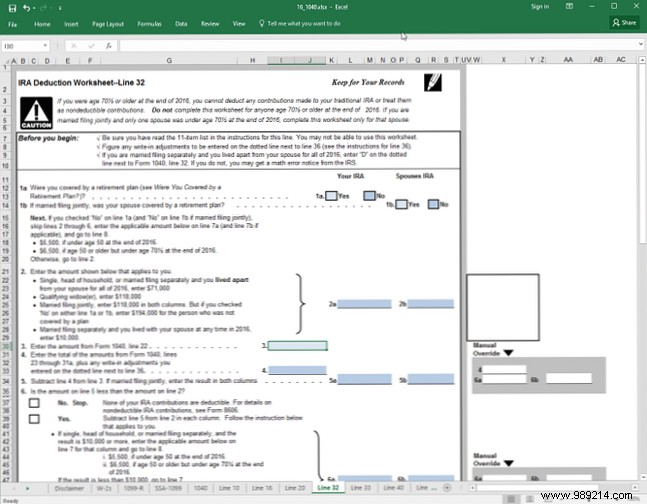

It's Comprehensive The XLSX includes Forms W-2, 1099-R, SSA-1099, and 1040. In addition, Reeves has created separate worksheets for almost all of the calculations, as well as including the numerous tax schedules. Reeves' meticulous planning and structure earn much applause.

As you might expect, Reeves protects the workbook sheets to prevent unwanted changes. He can unlock the sheets and make tweaks if he wishes, but this could result in an inaccurate tax return. He would suggest you leave the document protection in place for him, at least until he has done his tax calculations.

Ultimately, Reeves does all of this, essentially walking you through your federal income tax calculation, for free. However, he accepts donations, which he says "feeds his ego," encouraging him to continue his "labor of love" for another year. You'll be glad to know that Reeves reports all donations from him. -and He even donates some to his local church..

To use Excel1040, simply download and open the XLSX file.

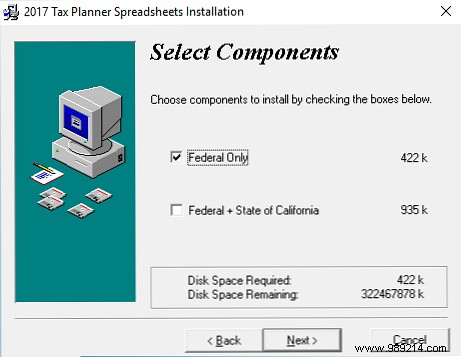

Taxvisor has produced a calculator every year since the 1990s. Interestingly, Taxvisor is actually contained in an executable file which, I must admit, worried me. However, after first installing the Taxvisor executable on a virtual machine, I can confirm that it is legitimate and will not cause any harm to your system.

The tax advisor has four worksheets:Single Filing, Joint Filing, Married Filing Separately, and Responsible Filer. The four sheets list specific federal tax parameters for each tax return.

Taxvisor also has a helpful legend detailing your income, taxes due, remaining taxes due, and of course your tax summary. Like Excel1040, Taxvisor worksheets are protected to stop unregulated modifications that could lead to an inaccurate return.

In general, Taxvisor is easy to use. It doesn't offer the wide range of additional worksheets and tax programs included with Excel1040, but it does focus on the simpler and much cleaner design aids. Similarly, there may not be super-detailed instructions, but each entry has a minute-long tip that quickly details the use of the box. But don't let the simplistic approach fool you. Taxvisor is still a fully featured tax calculator.

There is always the option to create your own tax calculator, but you will need to be prepared. First, there are some Excel formulas you should know:

The linked article explores how you can use each formula to use 16 Excel formulas to help you solve real-life problems. 16 Excel formulas to help you solve real life problems. The right tool is half the job. Excel can solve calculations and process data faster than your calculator can. We show you the key Excel formulas and show you how to use them. Read more . For example, VLOOKUP is perfect for finding and returning values in a tax table, while you can use ISPMT to calculate the amount of interest paid on your outstanding loans.

You should also consider the different levels of taxes, standard deductions, exemptions and contributions. They change almost every year, just to keep you on your toes. The IRS website is the best place to start. 7 IRS website tools that could save you time and money. 7 IRS website tools that could save you time and money. They make your job much easier. Don't give up yet. Read more . Around October of each year, the IRS releases a tax update summary detailing what has changed. You can find the summary here and the full update document here [PDF].

However, these only cover reforms and tax structures. If you contribute to a Roth IRA, you need to know the contribution limit for your tax status. The same can be said for student loan payments and interest, and so on. In addition to this, individual states have specific tax laws. Check local tax specifications with the FindLaw State Tax Law search engine.

The IRS provides a comprehensive Tax Topics Index that covers the top questions. The IRS website's search function is also quite useful. As with most taxes, it is very likely that another citizen has had the same question.!

Taxes don't have to be taxes. It happens every year whether we like it or not, and paying taxes is essential for a society to function. Planning ahead is the key to success. Keeping receipts, pay stubs, and statements in one place will reduce your stress until the end of April. And remember, you have to pay taxes on earnings from sites like eBay or Craigslist.

The two templates provided are extensive. Excel1040 and Taxvisor will turn a tax nightmare into a dream The best strategies to claim a tax return this year The best strategies to claim a tax return this year Nobody likes to pay taxes. But we have to. Good tax software can not only help you file taxes effortlessly, but can also minimize your tax burden at times. Read More Please remember that these are just calculators. You Have Yet to File Your Return 6 Best Free Tax Software to File Your Next Return 6 Best Free Tax Software to File Your Next Return If you're tired of paying to file your taxes, you'll love these six free options for filing your return of taxes. State and federal forms. Read more !

Can you recommend templates or strategies that make taxes easier? Let's hear them in the comments!